BoMW

Well-known member

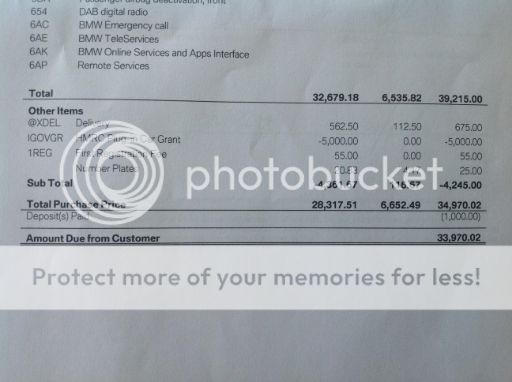

I have just calculated my invoice by deducting the grant from the outset, it seems that I am able to save nearly £1000 in VAT if its calculated this way. Of course I could have completely got this wrong but does anyone know when the grant should be levied in the price calculation?