Hello all first time post, this place seems like a very helpful community  do you think this is a good deal? something seems off to me this will be my first lease ever, im new to all of this.

do you think this is a good deal? something seems off to me this will be my first lease ever, im new to all of this.

apparently i needed a co-signer because i got declined since this is my first loan ever. but the manager talked to financial for hours and was able to get me this deal. i am able to get a cosigner but these guys seemed desperate to get rid of the vehicle today. they even bought me lunch.

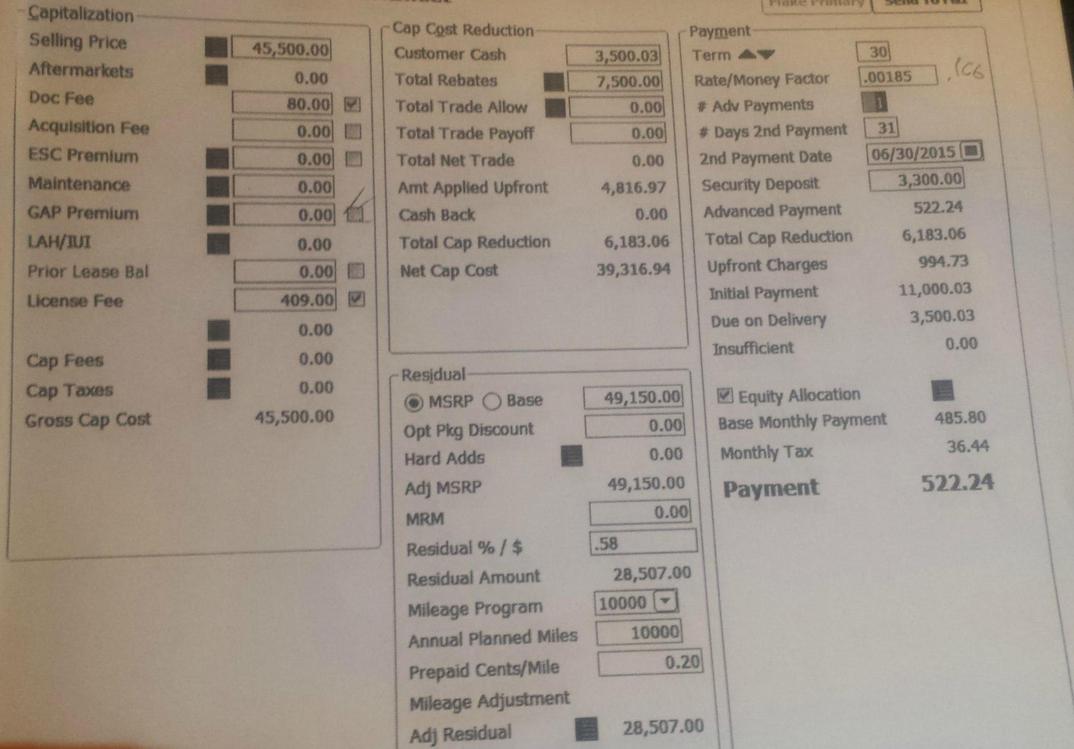

it is for a 2014 i3 with tech and nav options.20" rims came out to 49,150 MSRP

dealer said they will take it down to 46,000 and not make anything. i sald go lower, so now they are at 45,500 telling me they are now losing money.

**LOCATION SOUTHERN CALIFORNIA**

MSRP $49,150

gross cap cost/selling price $45,500 ***are they really losing money? ***

total rebates : $7,500

net cap cost: $39,316

cash up front i need to give is $3,500, which they said i will get back around $3,000 at the end of lease

term. 30 months/10,000 i chose 30 months to get a $2,500 ca rebate when do i get the rebate?

M.F.: .00185 but the first deal they offered a lower .00166 so i dont know why this went up. sneaky guys?

my credit score is 734 im new to all of this but i think im learning very fast !

residual : .58

payment : $522.24 /per month which seems high seeing that some of you pay only $380.00

the manager seemed VERY UPSET THAT I HAD TO LEAVE.he even chewed out the sales person that promised him i could get 3,500 cash, but the bank closed. they kept me for 3 hours trying to talk to financial services, almost makes me not want to go back.

what do you think?

apparently i needed a co-signer because i got declined since this is my first loan ever. but the manager talked to financial for hours and was able to get me this deal. i am able to get a cosigner but these guys seemed desperate to get rid of the vehicle today. they even bought me lunch.

it is for a 2014 i3 with tech and nav options.20" rims came out to 49,150 MSRP

dealer said they will take it down to 46,000 and not make anything. i sald go lower, so now they are at 45,500 telling me they are now losing money.

**LOCATION SOUTHERN CALIFORNIA**

MSRP $49,150

gross cap cost/selling price $45,500 ***are they really losing money? ***

total rebates : $7,500

net cap cost: $39,316

cash up front i need to give is $3,500, which they said i will get back around $3,000 at the end of lease

term. 30 months/10,000 i chose 30 months to get a $2,500 ca rebate when do i get the rebate?

M.F.: .00185 but the first deal they offered a lower .00166 so i dont know why this went up. sneaky guys?

my credit score is 734 im new to all of this but i think im learning very fast !

residual : .58

payment : $522.24 /per month which seems high seeing that some of you pay only $380.00

the manager seemed VERY UPSET THAT I HAD TO LEAVE.he even chewed out the sales person that promised him i could get 3,500 cash, but the bank closed. they kept me for 3 hours trying to talk to financial services, almost makes me not want to go back.

what do you think?